Background

Financial tools that allow farmers to effectively manage their risk are essential to improve production and resilience. Generally, these tools allow farmers to spread risk among other farmers and across time.

Index insurance has emerged as such a tool; farmers pay an insurance company a premium and receive a payout if an index detects conditions falling below a threshold. However, index insurance only covers losses that are experienced at an aggregate level (“covariate”); in some areas, shocks are experienced primarily at the household level (“idiosyncratic”). Index insurance also carries the possibility that the index will fail to register losses (“basis risk”). Moreover, farmers often are hesitant to trust insurance companies, located far from their community. All of these factors limit take-up of index insurance.

Project Approach

Project Overview

Principal Investigators:

Michael Carter, UC Davis

Sarah Janzen, University of Illinois

Suhindra Sharma, Inter Disciplinary Analysts

Project Partners:

Muktinath Bikas Bank

Country: Nepal

Timeline: 2023-2027

The Resilience+ Innovation Facility and Bankable Frontier Associates (BFA) have partnered with Muktinath Bikas Bank to develop a suite of complementary financial tools to help farmers manage risk. The pilot is being run among 1,000 farmers in two regions of Nepal.

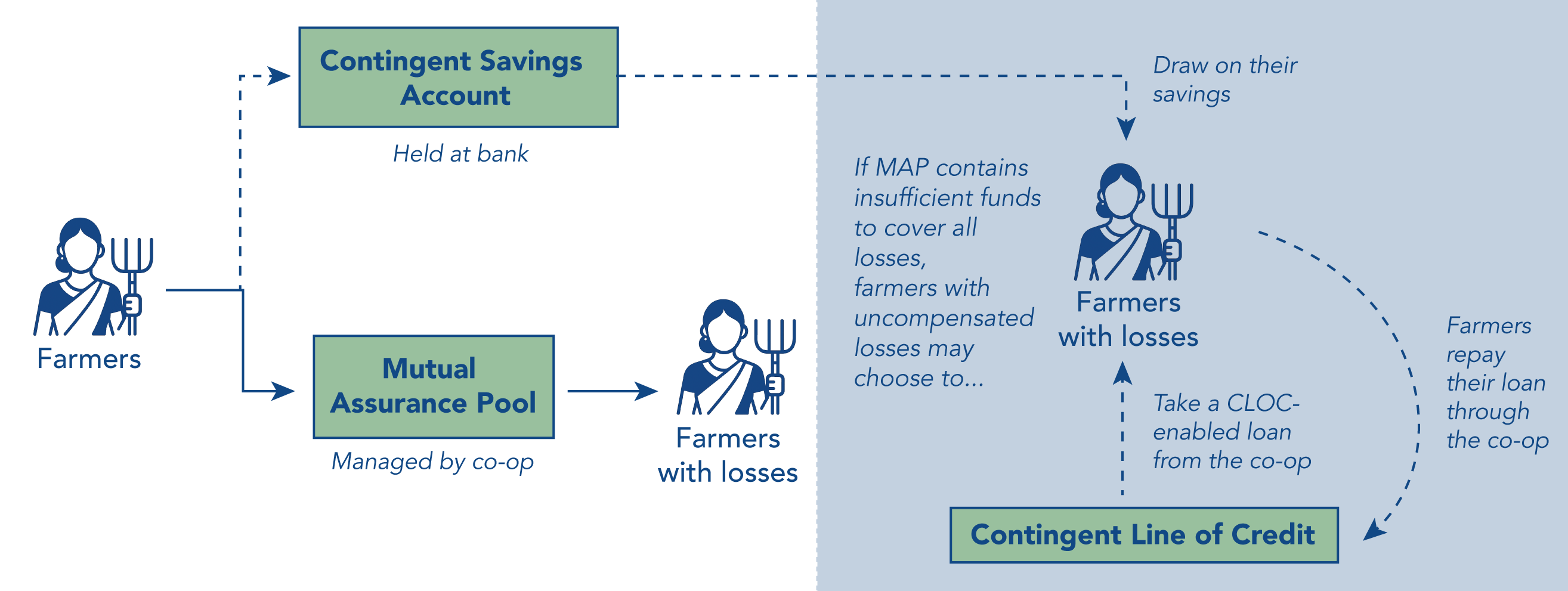

The approach is built around a fail-safe Mutual Assurance Pool (MAP). Managed by farmer cooperatives, the MAP is funded via a 2% surcharge on inputs that farmers purchase through the cooperative. MAP funds are held as an account owned by the cooperative at Muktinath Bikas Bank. When farmers incur crop losses (either covariate or idiosyncratic), the community-based MAP committee verifies that a no-fault loss occurred. Then the MAP makes pay-outs, according to the level of crop loss. Farmers experiencing 100% losses are eligible for a payout equaling the total amount they spent on inputs.

In case of widespread losses among farmers in a given season (i.e., due to poor growing conditions), the MAP funds may be insufficient to cover full losses. In this case, the bank activates a Contingent Line of Credit to the cooperative in the amount needed to cover remaining losses. Farmers can choose to take a loan through the cooperative; later, they pay it back to the cooperative, and then the cooperative pays back the bank.

A Contingent Savings Account offers an additional financial option for farmers amid losses. Farmers who opened a Contingent Savings Account have the option to withdraw their funds at a preferential return (accumulated interest at an above-average rate) when a loss occurs.

If results of this pilot are promising, Muktinath Bikas Bank plans to test the products at a broader scale.