Index insurance can help farmers manage risk to crops from environmental factors. Avoiding the costly work of verifying individual losses, index insurance uses a remotely-assessed measure, triggering payouts at an aggregated level when a threshold is crossed. Research has found that well-designed index insurance can contribute to the Resilience+ of rural farming households.

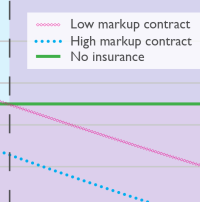

However, index insurance does not universally make people better off. Substantial design variation exists across index insurance contracts. Our Minimum Quality Standard is based on the premise that index insurance should leave farmers better off than if they had no insurance at all—ideally, it should leave them much better off. Index insurance can make people worse off in cases when:

- The contract’s premiums are too high and/or payouts are too low. In particular, if indemnities are significantly lower than the scale of losses, the insurance contract is not considered high quality.

- The index fails to register a loss-inducing shock, as the farmer not only experiences losses but also lost net income to the premium payment.

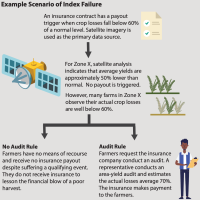

The term ‘basis risk’ describes the occurrence of the second scenario. Discrepancy between index values and individual farmers’ experience has two causes, described below along with strategies to reduce the discrepancy. Additionally, guaranteeing an audit when farmers believe the index has failed can provide fail-safe assurance that the insurance will provide protection. Read more here.

1. Inaccurate detection. An index might not accurately detect average production in a zone—whether via inaccurate measurement, or the measure poorly predicting actual outcomes. Recent developments in satellite imagery are improving accuracy.

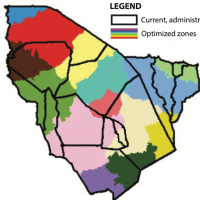

2. Intra-zone variation. Outcomes of some individual farms may differ from the index, which is generally the zone average. This is particularly a challenge in regions that contain significant variation (i.e., in soil type, terrain, rainfall patterns) that affect plant and livestock growth. The de-facto boundaries used for insurance zones are administrative, which may have no relationship to physical geography. Researchers have determined that index insurance will hold more economic value when zones group farms that tend to suffer losses together. Read more here.

Publications

Brief: A Minimum Quality Standard to Ensure Index Insurance Contracts Do No Harm

Standard economic and statistical tools make it possible to establish a Minimum Quality Standard for index insurance products.

Brief: An Audit Rule as a Fail-Safe Mechanism in Index Insurance Contracts

An audit rule that is activated when farmers believe the index has failed can add assurance that the insurance will provide protection as intended.

Brief: Optimizing Index Insurance Zones

Instead of creating zones for index insurance subscribers using administrative boundaries, grouping farms that experience losses together brings more economic value.

Paper: Index Insurance for Developing Country Agriculture: A Reassessment

Existing constraints on take-up can partially be overcome using revised contract designs, advanced technology for better measurement, improved marketing, and better policy support.

Paper: Evaluating the quality of remote sensing products for agricultural index insurance

Relative Insurance Benefit (RIB) expresses the welfare benefits derived from an index insurance contract relative to a hypothetical contract that perfectly measures losses.

This page is under development