Rural households in Sub-Saharan Africa and South Asia face significant a risk that weather-related disasters like severe drought and flood will destroy their agricultural livelihoods. In the wake of shocks, they are often forced to engage in costly coping strategies that compromise their ability to recover. The risk of shocks in itself creates hardship when households forego investments in improved seeds or other ways to increase the size of their harvests.

Households with reliable and affordable tools to manage risk are more likely to be resilient to shocks. Today, these tools can be financial, such as agricultural index insurance, or agronomic, such as varieties that can withstand some drought and flooding. These tools can also be bundled together to increase the overall protection they provide and maximize a household's potential gains from adopting them.

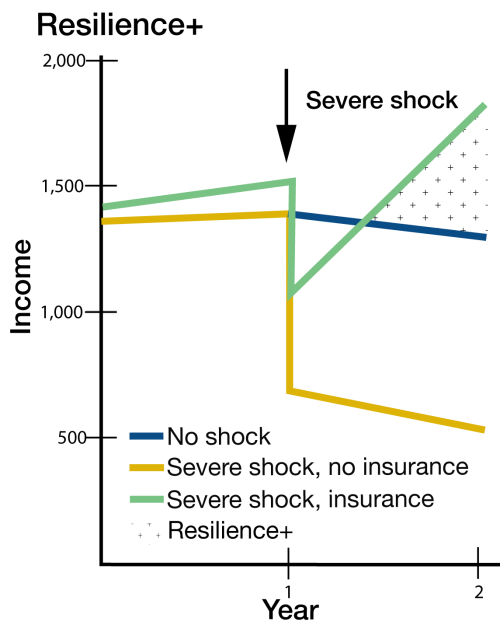

There is an additional benefit possible when rural families know that they will be protected in the event of a shock. The added security can free them to make new investments to grow more food. Because of this, effective tools to manage risk not only protect current well-being and promote resilience, but can provide a solid foundation for future improvements in well-being.

Together, resilience to shocks and the resulting investments build what we call Resilience+. The Resilience+ Innovation Facility is leveraging a decade of field evidence generate Resilience+ and accelerate efforts to sustainably strengthen food security and spur inclusive agricultural transformation.

Risk Management Tools for Building Resilience+

Index Insurance

The concept of Resilience+ is built on evidence on the impacts of agricultural insurance for individual rural households. Field trials have shown that index insurance, if effective, can produce two kinds of critical impacts: ex-ante impacts and ex-post impacts in relation to a shock.

The case for insurance is based in large measure on its ex-post impacts, in how insurance changes the way a household copes with a shock. Evaluations of the Index-based Livestock Insurance in Kenya, for example, have found that the insurance fundamentally changes coping strategies among pastoralist households whose livelihoods depend on livestock. For poorer households, the insurance reduces reliance on meal reduction as a post-shock coping strategy (Janzen and Carter, 2019). Another study found that insurance allowed cotton farmers to preserve their capital to plant again a year after a severe shock that otherwise would have forced them to sell off equipment and exit cotton production at least for the short-term (Stoeffler et al., 2021).

Several studies in other settings have found additional benefits beyond shifts in coping strategies that can have devastating long-term impacts. With microinsurance, there are households that avoid decapitalization in the wake of shocks and also show higher rates of agricultural investment in the year following a shock and insurance payout compared to uninsured households.

These additional investments are an example of the ex-ante effects of insurance, which are the effects of insurance before a shock occurs. If a household expects to be able to cope with a disaster, they are more likely to take on productive investments they otherwise would not risk, such as improved seed varieties or costly agricultural inputs that can increase agricultural productivity and income. A handful of studies have established that insurance can lead to substantial ex-ante increases in on-farm investment.

Not all index insurance products are equally effective; visit the Insurance Quality Resource Page to learn more. Index insurance can be complemented by other financial products – including those that carry less risk (premium payment) to get familiar with the index. Learn more on the Bundled Financial Tools Resource Page.

Stress-Tolerant Seed

Stress-tolerant seed varieties have been specially bred to withstand weather-related shocks like drought or flood. Stress-tolerant crop varieties are a particularly attractive innovation because of their very low marginal cost. While breeding these varieties demands substantial upfront investments in lab work and field trials, once varieties are developed they can be multiplied and distributed to farmers with little or no additional cost compared to other varieties.

Despite the low marginal costs of producing stress-tolerant seeds, they offer farmers protection against only a limited range of the shocks that they confront. The drought-tolerant maize varieties studied by Boucher et al. (2024) protect against mid-season drought, but remain vulnerable to early and late season drought in addition to the other biotic and abiotic stresses that afflict other maize varieties. This limited or single peril protection reflects the fact that plant breeders face biological constraints that limit how much and what types of stress these new varieties can withstand.

Case Study: Maize Farming in Mozambique and Tanzania

Small-scale maize farmers in East Africa face a high risk of drought that destroys their crops and livelihoods. Mozambique faces a risk of both severe drought and extreme weather that causes widespread flooding. Tanzania faces a high risk of drought that destroys crops and forces small-scale farmers to forego investments in higher productivity.

Thus, stress-tolerant seeds alone are not necessarily an adequate foundation for farmers to increase their investments that would generate Resilience+. However, the evidence on these varieties raises the possibility of bundling financial instruments like index insurance with stress tolerant seeds. Bundling with such an instrument could provide smallholder farmers more comprehensive risk mitigation and more effectively reduce the welfare burden of uninsured risk.

Measuring Resilience and Resilience+

Given the importance we attach to Resilience, it is critical to have a shared understanding of what it is and how we know when it’s been achieved. Visit the Resilience Measurement Resource Page to learn how the Resilience+ Innovation Facility conceptualizes and measures Resilience and Resilience+.

Cited Works

Boucher, S., Carter, M.R., Flatnes, J.E., Lybbert, T.J, Malacarne, J.G., Marenya, P.P., & Paul, L.A. (2024). “Bundling Genetic and Financial Technologies for More Resilient and Productive Small-Scale Farmers in Africa.” The Economic Journal, 34(662), 2321-2350.

Janzen, S. and M.R. Carter (2019). “After the Drought: The Impact of Microinsurance on Consumption Smoothing and Asset Protection,” American Journal of Agricultural Economics.

Stoeffler, Q., Carter, M., Guirkinger, C., & Gelade, W. (2021). “The spillover impact of index insurance on agricultural investment by cotton farmers in Burkina Faso.” World Bank Economic Review.

Publications

Brief: Generating Resilience+ to Reduce Poverty and Spur Agricultural Growth

Farmers receiving both drought-tolerant seeds and index insurance who experienced shocks and saw the technologies in action subsequently increased their agricultural investment beyond pre-shock levels.

Paper: Bundling Genetic and Financial Technologies for More Resilient and Productive Small-Scale Farmers in Africa

Farmers in the treatment group receiving both drought-tolerant seeds and index insurance who experienced shocks and saw the technologies in action subsequently increased their agricultural investment beyond pre-shock levels.

Case Study: Index insurance increases cotton farming in Burkina Faso and Mali

In this trial, as cotton farmers accessed index insurance to manage their risk, they also started planting more.