Background

Farmers in Bangladesh are no stranger to climate shocks that damage their crops. Amid a poor harvest, small-scale farming households may sell off productive assets, which damages their long-term earning potential.

BRAC has already taken steps to research and design solutions to build the resilience of their small-scale farmer clients, piloting crop insurance and an emergency line of credit.

Project Overview

Principal Investigators:

Michael Carter, UC Davis

Project Partners:

BFA Global

BRAC

BRAC Institute of Governance & Development

SENA Insurance PLC

Country: Bangladesh

Timeline: 2023-2027

Project Approach

Building off BRAC’s learnings and additional qualitative research, this project offers a bundle of three financial products, all tied to the same index, to rice and potato farmers.

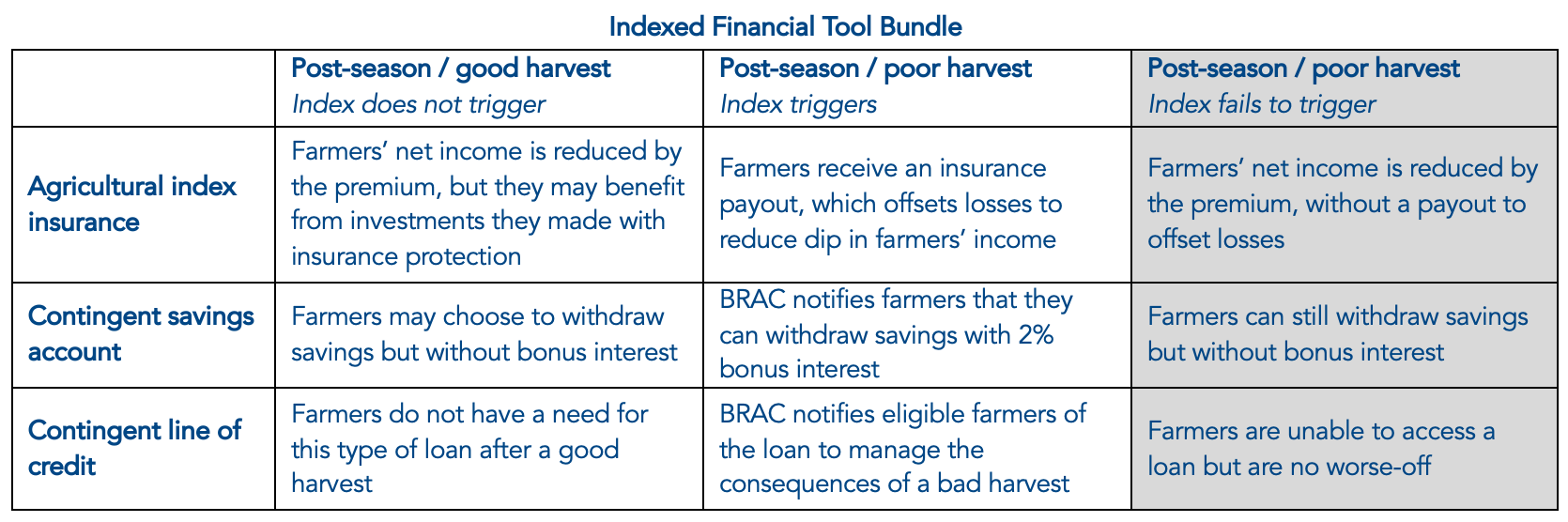

The Resilience+ Innovation Facility is working with SENA Insurance PLC to offer a quality Index Insurance product. The insurance uses an ‘area-yield’ index to predict whether farmers have experienced losses.

SENA shares the index report with BRAC, which uses the results by geographic zone to determine farmer eligibility for two contingent products that season.

If the average yields in a district fall below 70% of the historical average, farmers who have been pre-approved based on their credit history are eligible for a Contingent Line of Credit. This 12-month loan is intended to reduce financial pressure on farmers who may struggle to make payments amid a bad harvest. Instead of selling off productive assets, eligible farmers can use the loan for liquidity, gradually paying it back with income from other crops in the next season and/or non-agricultural income streams.

Farmers may also opt to make deposits into a Contingent Savings Account. All deposits plus standard interest may be withdrawn at any time, but farmers receive an additional 2% accumulated ‘bonus interest’ if they withdraw when the index is triggered.

Farmers’ use of all three of the products are vulnerable to so-called ‘basis risk’ events, when the index fails to register a loss in bad year (or incorrectly register a loss in good years). However, with multiple financial products, each of which has different consequences if the index fails to register a loss (see grey column in table), farmers may hedge their risk against the consequences of index failure.

The project will track customer journeys for the bundled offering, including how they move between the different products. The project will also develop and test new credit scoring models, which may help BRAC to qualify some customers faster.