Background

When farmers rent land to farm in Ethiopia, a sharecropping arrangement is almost always used. Under this rental structure, half of the crop revenue goes to the land owner as payment. Because farmers share the rewards of investment under sharecropping, they tend to put less in—from their own labor to inputs like fertilizer—than they would on land they own. As a result, land under sharecropping has lower average yields.

Farmers are aware of this incentive structure and how it affects their decisions around farm investment. Global evidence suggests that switching to fixed rent contracts, which would allow farmers to realize the full impacts of their investment, would increase farm productivity. In Ethiopia, where agricultural productivity tends to be low, reducing barriers to yield growth is critical.

Project Overview

Principal Investigators:

Solomon Zena Walelign, Ethiopian Policy Studies Institute

Michael Carter, UC Davis

Project Partners:

Abay Bank

BFA Global

Nyala Insurance Company

Sarota Wolaita Saving and Credit Cooperative Union

NASA Harvest

Country: Ethiopia

Timeline: 2025-2026

Constraints to Address

Most farmers are not ready to move away from sharecropping, given the structure address two key constraints:

1. Liquidity: Under sharecropping, tenant farmers need not make upfront payment for the land when the season begins—a time when most farmers have very limited cash on hand.

2. Risk: Farmers share the risk of crop failure with the landlord, as the cost of rent is null amid a failed crop.

In order to move farmers away from sharecropping, toward the productivity-boosting arrangement of fixed rent, financial tools for addressing the constraints of liquidity and risk are needed.

Land owners would likely be no worse off, and possibly better off, under a fixed rent arrangement.

Project Approach

The Tenancy Reform Risk Management Project offers an interlinked creditinsurance contract to help farmers thrive in a fixed rent arrangement.

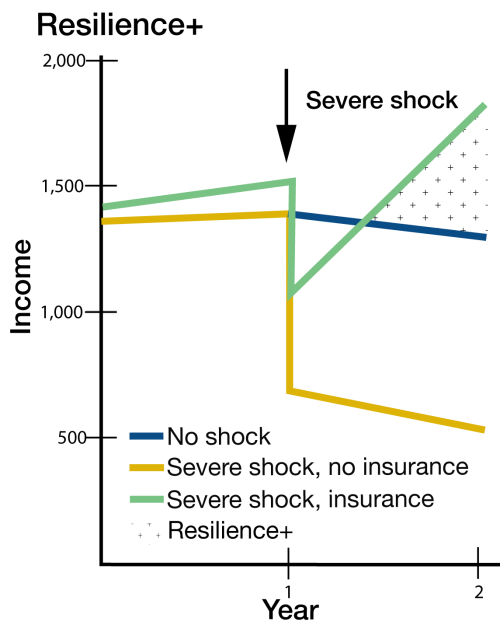

An insured rental loan is offered to tenant farmers to address the liquidity constraint. The 8-month loans allows tenants to pay fixed rent in cash at the beginning of the season. Farmers repay the loan with interest at the end of the season, instead of splitting their revenue. In most seasons, tenants will have more income than they would under sharecropping. In the case of a bad season, when estimated local yields fall below 45% of average levels, the lender receives repayment insurance payouts. These funds cover the cost of the loans that farmers are unable to repay, up to the full amount amid crop failure. The insurance premium is included in the cost of the loan, and comprises about 10% of the total amount. The loan repayment insurance largely addresses the risk constraint, as tenant farmers remain shielded from paying rent beyond their revenue.

Some risk remains that tenants will be worse off under fixed rent than sharecropping when yields are under 70% of average, which occurs approximately 10% of the time. Under fixed rent, their meager revenues are applied to partial loan repayment, while under sharecropping they would still have some income. For this reason, the project also offers partial income guarantee insurance, which prevents tenants’ income from dropping below what it would have been under sharecropping.

Alleviating the constraints that have kept farmers in sharecropping arrangements, the financial tools offered under the project will allow farmers to confidently transition to fixed rent arrangements, which are expected to substantially boost farmer income and productivity.